Trafficking with smuggled cigarettes raises special issues at the Romanian borders; the huge detected quantities and the way through which their entry in the country was attempted show that this phenomenon is still at a high level.

The smugglers stake on the impressive “profit” they can obtain through the trading on the “black markets” in our country, but also the ones in the West, considering the price differences. In general, the persons involved in such activities reside in the border area, having the possibility to transport in a short time the cigarettes from the border and to store them until a subsequent transportation to the urban centers for trading.

The maximum legal limit of cigarettes which can be entered in Romania is 2 packs containing 20 cigarettes (from a non-EU state).

NATIONAL APPLICABLE LAW:

- Customs code

- Entry or exit into/from the country of a cigarette quantity through the established places for customs control, by circumventing the customs control, amounting up to RON 20 000, is an offence and shall be subject to a penalty between RON 5 000 and 10 000 and the seizure of the goods.

- Entry or exit into/from the country, twice a year, of a cigarette quantity through the established places for customs control, by circumventing the customs control, amounting up to RON 20 000, is a crime and is punishable with imprisonment from 2 to 7 years and the denial of certain rights.

- Entry or exit into/from the country, by any means, of a cigarette quantity at places other than the ones established for customs control, is a crime and is punishable with imprisonment from 2 to 7 years and the denial of certain rights.

- Entry or exit into/from the country of an undeclared quantity of cigarettes, amounting to more than RON 20 000, is a crime and is punishable with imprisonment from 2 to 7 years and the denial of certain rights.

- When the two crimes abovementioned are committed by one or several armed persons or by several persons together, represents aggravating offences and is punishable with imprisonment from 5 to 15 years and the denial of certain rights.

- Collection, possession, taking-over, storing, handing-over, disposal and trading of smuggled cigarettes or are used for smuggling is considered smuggling and is punishable with imprisonment from 2 to 7 years and the denial of certain rights.

- Fiscal code

- Possession or trading of cigarettes without a fiscal stamp or with inadequate fiscal stamp, or with false markings over the limit of 10 000 cigarettes, or more than 1 kg of smoking tobacco, represents a crime and is punishable with imprisonment from 1 to 5 years.

USED ROUTES:

- At the northern border (Maramureș, Suceava, Satu Mare Counties), the cigarettes from Ukraine are prevalent, the smugglers are organized in criminal groups, with branches abroad, at the border and inside the country. They attempt to cross the cigarettes packs (master cases) over the “green” border, especially at night.

- At the eastern border (Galați, Vaslui, Iași, Botoșani Counties), the cigarettes from Republic of Moldova (inferior quality cigarettes - Plai, Doina, Plugarul, MT) are prevalent, their entry into the country is made through the border crossing points, either in large quantities in special designed transportation means, or in small quantities – within the limits of the customs ceiling – by natural persons.

- In the south-western counties (Caraș-Severin, Mehedinți, Timiș) are detected, in general, medium and superior quality cigarettes purchased from duty-free shops and crossed over the border, in small quantities, by natural persons.

USED METHODS:

- ‘lid’ method consists in the concealing of the cigarette packs among other types of freight - especially the goods with small taxes – transited legally through the border crossing points;

- ‘insulation’ of vehicles with cigarettes , consisting in the concealing of packs in different component parts (tyres, longerons, doors etc.) or using double walls;

- concealing the cigarettes in clothing or stick to the body, in the wrappings of other food products or in double bottom bags;

- ‘cable’ method, used in the river border area, which means the crossing of the cigarette master cases on a cable fixed on the two shores of the watercourse;

- transiting the mountainous border area with horse-drawn vehicles, taking advantage of the rough, mountainous terrain, thus making difficult the checking of the routes;

- using flying devices – powered hang glider / sailplane / drone – which are modified for transportation of master cases over the border.

In 2018, at national level, 112 861 995 cigarettes were seized amounting to RON 49 762 082, 929 persons were detained and 184 transportation means were confiscated (according to the data recorded on stopcontrabanda.ro).

Romanian Border Police, independently or in collaboration with the customs inspectors, confiscated 95 589 880 smuggling cigarettes and 1 406 kg of tobacco.

We believe that the citizens have a very important role for countering this phenomenon supporting the law enforcement agencies by reporting the criminal activities in our competence area. The Romanian Border Police makes available a telephone line, 021.9590, where anyone can report such kind of acts.

At the same time, they can refuse the procurement of such products on the black market. Through the procurement of non-taxed cigarettes, besides the fact that they “supply” the underground economy, they put at risk their health. The detected cases regarding smuggled cigarettes or unfit for consumption are frequent due to the price at the moment of procurement which is lower than the price of trading on the market in Romania.

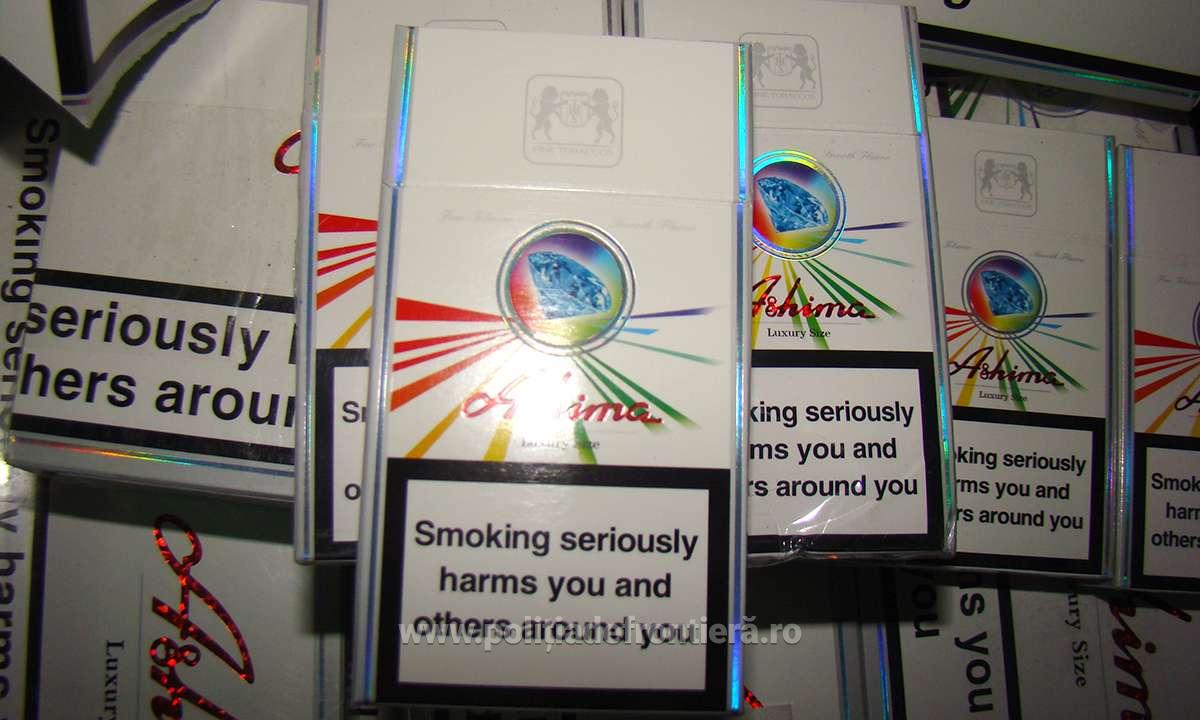

According to the Novel data of April 2018, 60% of the smuggled cigarettes consumed in Romania are Marble and Ashima, whose origin is not identified.

Given the financial losses in the State budget, (in 2018 - approximately RON 3 billion), the Romanian Border Police will continue to undertake together with the other responsible institutions firm measures in all the competence areas, in order to detect or penalize the persons involved in the illegal trafficking with consumer goods and excisable goods.